Introduction

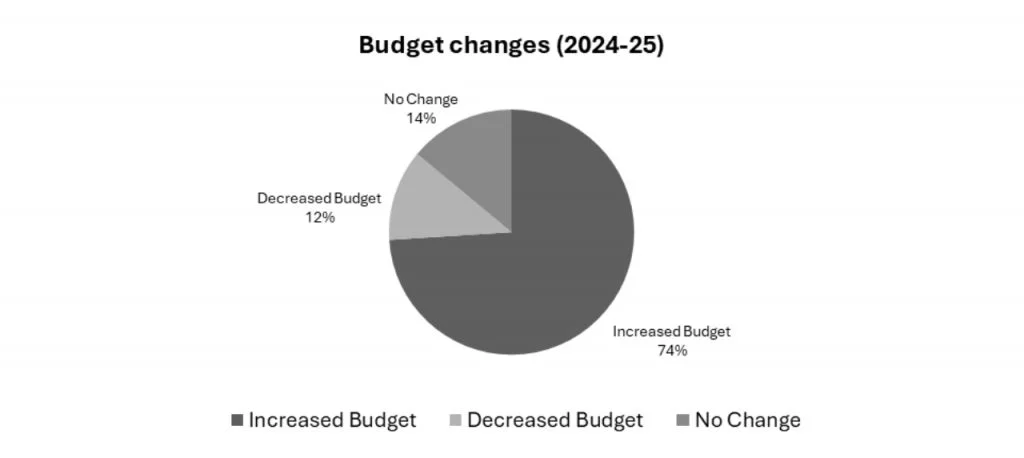

The U.S. B2B trade show industry faces a paradox that defies conventional business logic – 74% of Fortune 1000 exhibitors increased event budgets in 2025, yet only 6% express confidence in their ability to convert event leads—down from 9% the previous year.

This isn’t a perception problem. It’s a measurement and execution crisis hiding in plain sight.

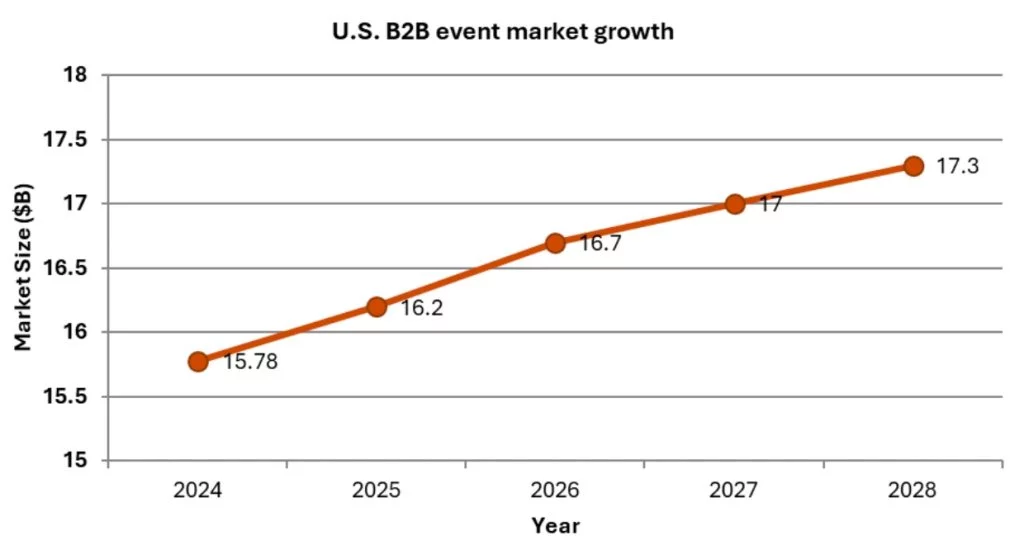

The $15.78bn U.S. B2B event market continues growing toward $17.3bn by 2028, yet 80% of trade show leads never receive any follow-up at all. And when exhibitors do follow up, 40% wait 3-5 days—long after the critical conversion window closes.

Key findings

- The “72-hour follow-up window” is actually 24-48 hours—after which conversion probability decays 20% daily

- Pre-event engagement determines 76% of attendee agendas, yet most exhibitor investment focuses on booth experience

- System maturity (manual vs. digital vs. integrated CRM) creates measurable 2-3x performance deltas

- Exhibitors track volume metrics while outcomes depend on quality metrics

- 80% lead leakage isn’t intentional abandonment—it’s process failure

The 2025 U.S. B2B event market baseline

| $15.78B U.S. B2B event market | 74% Fortune 1000 increased event budgets | 6% Confident in lead conversion |

Flagship event performance 2025

| Event | Attendees | Exhibitors | YoY Change |

| CES 2025 | 141,000 | 4,500+ | +2% |

| RSA Conference | 43,500 | N/A | +8% |

| IMEX America | 17,000+ | N/A | 15-yr high |

As the $15.78B U.S. market grows and 74% increase spending, exhibitor confidence collapses to just 6%.

___

Cite this Report: momencio (2026). “2026 State of U.S. B2B events report” Available at: https://www.momencio.com/guide-book/state-of-b2b-events/